WAVE ACCOUNTING PLATFORM - BAS Reports

The Wave Accounting platform is rather robust, especially given that it's free. I had been using it for a while and it suits me just fine however there are definitely a few things that you need to manually tweak yourself.

BAS reports are one of these unfortunately.

The problem that I have encountered when using WAVE for BAS reports in Australia is fundamentally that WAVE often considers the date of issuing an invoice important to the BAS, whereas I generally only want to tally invoices that have actually been finalised (PAID) by a client in that quarter. Likewise, bills raised, but yet to be paid out by me, are also automatically included within this report so the automatic reports generated (REPORTS > Sales Tax Report) are often/always wrong if we’re looking at only reporting what money was ACTUALLY received or spent during a BAS quarter.

So, to manually derive the correct values to report BAS figures that represent what was actually paid and received for a quarter, I follow these steps:

STEP 01 - Derive what money has actually been received

If you simply generate a Sales Report (REPORTING > Sales Tax Report) the values generated will, as mentioned, include money that has been invoiced but not yet received, as well as bills raised but not paid (by you) yet.

So, we'll calculate money received manually.

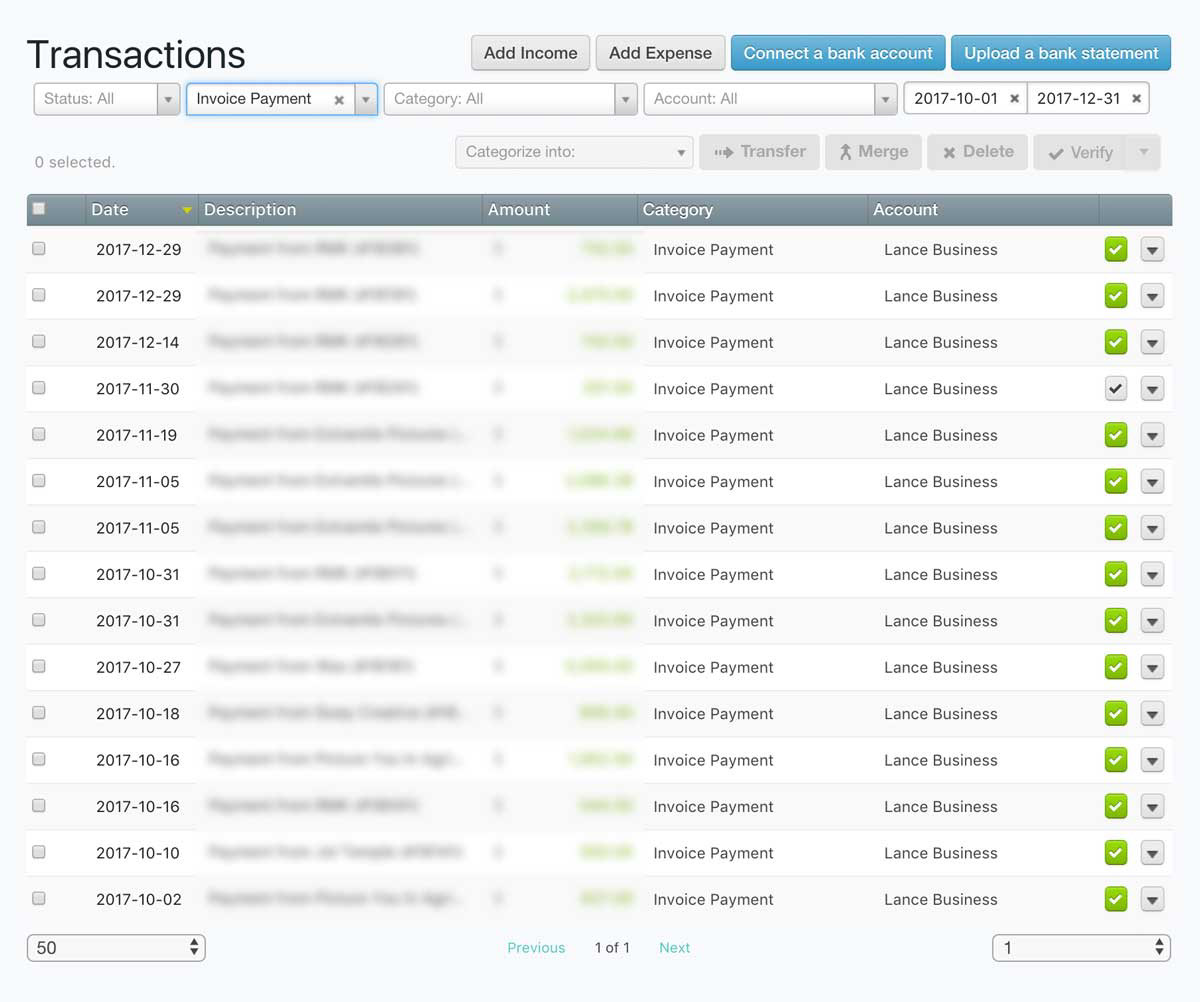

Select ACCOUNTING > TRANSACTIONS in the left side menu to bring up your transactions. We only want to look at the quarter in focus so utilise the filter tools to refine the listing to invoices paid in the quarter. For me, I refine using the below as money paid to me is always in payment of an issued invoice, but you business may receive money that isn't linked to issued invoices so cross check what you personally are trying to total.

STATUS: [All] ----- TYPE: [Invoice Payment] ----- CATEGORY: [All transactions] ----- DATES: [(as required)]

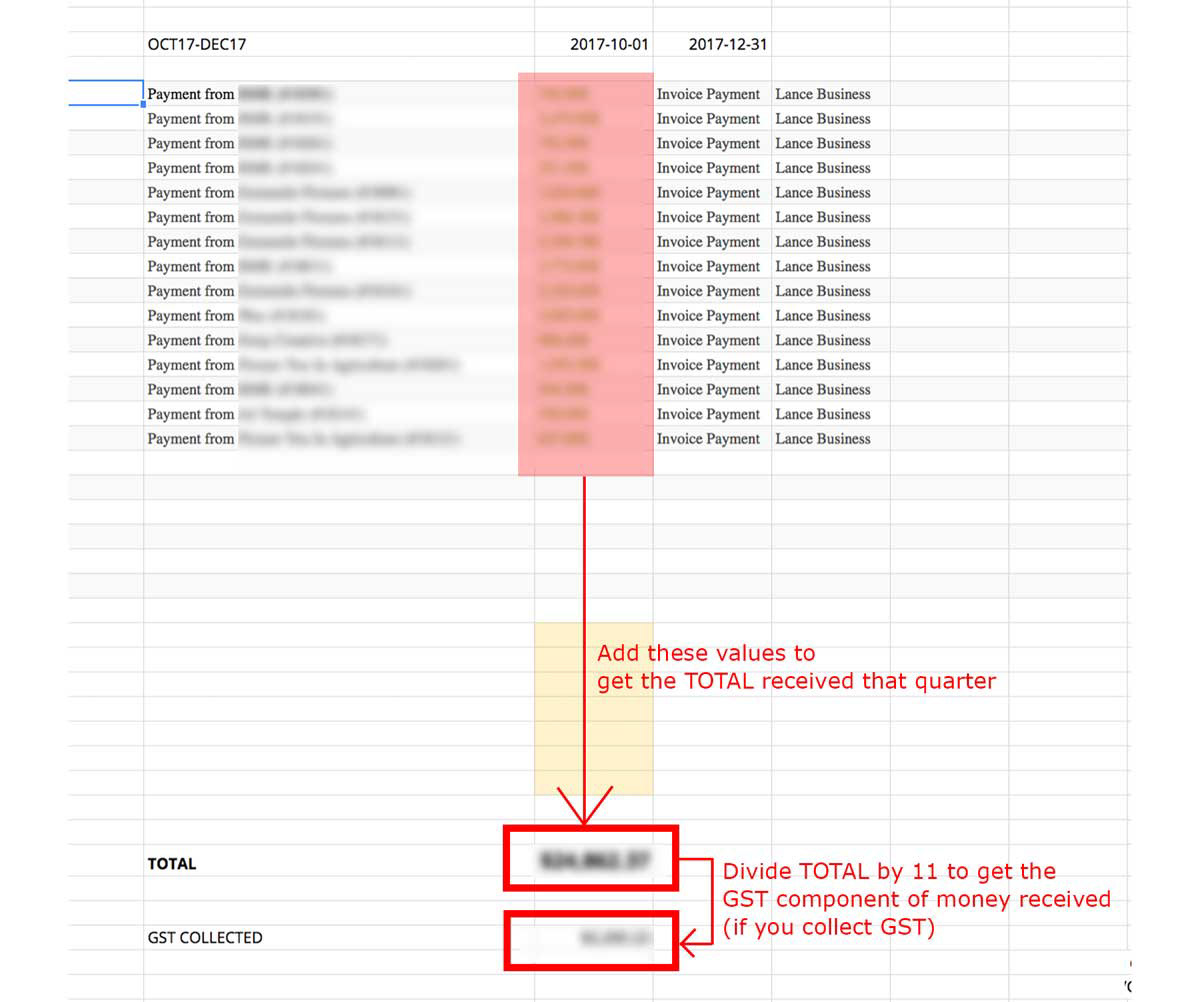

Change the number of displayed results per page to as many as possible if you have multiple pages of payments (100?) and copy this data across to a spreadsheet to total the money received. You may still need to copy the data from multiple pages if you have had more than 100 payments coming in for the quarter.

STEP 02 - Derive total GST paid on expenses for that quarter

Select REPORTING > Sales Tax Report, in the left side menu to bring up your GST paid/received (if you've set that up in WAVE). Again filter the dates to represent the quarter in focus.

Note again that the receivables may include bills raised but not paid. I've found the best way to avoid this is simply make the 'Bill Date' the same date as Bill Due' when you raise the bill (and change the date if the bill isn't paid exactly exactly on that date).

If you followed the above process then STEP 01 should have given you an accurate total for money that you actually received for that quarter, and the receivables generated in the Sales Tax Report should accurately depict expenses and GST paid on those expenses for the quarter.

Hope this has been helpful in utilising the WAVE platform.